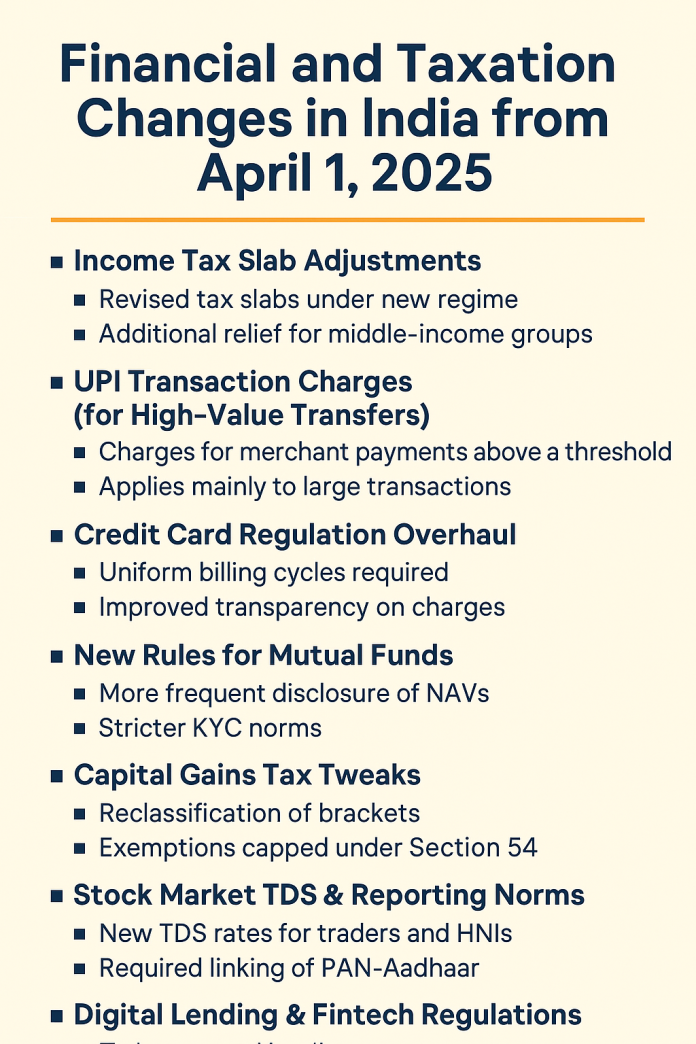

As the new financial year begins, several key changes in financial regulations and taxation have come into effect. These reforms, announced in the Union Budget 2025 and enforced by bodies like the RBI, SEBI, and NPCI, impact a wide range of people—taxpayers, UPI users, credit card holders, stock market investors, and mutual fund participants.

🔹 1. Income Tax Slab Adjustments

-

The government has slightly revised tax slabs under the new regime.

-

Middle-income groups may see additional relief in the form of increased standard deductions.

-

Senior citizens receive higher exemption limits and reduced compliance burdens.

🔹 2. UPI Transaction Charges (for High-Value Transfers)

-

NPCI has introduced charges for UPI transactions exceeding a specific threshold (e.g., ₹2,000 or ₹5,000).

-

These charges apply mainly to merchant payments and not regular peer-to-peer (P2P) transfers.

🔹 3. Credit Card Regulation Overhaul

-

RBI has mandated uniform billing cycles for better clarity.

-

Hidden charges and misleading cashback claims are now banned.

-

Issuers must provide transparent disclosure of interest rates and penalties.

🔹 4. New Rules for Mutual Funds

-

SEBI’s updated rules require more frequent disclosure of Net Asset Values (NAVs).

-

There are stricter KYC norms and risk labeling enhancements for investors.

-

Mutual funds must classify investments with greater transparency, particularly regarding ESG and small-cap funds.

🔹 5. Capital Gains Tax Tweaks

-

A reclassification of capital gains brackets (short-term vs. long-term) based on holding period and asset type.

-

Some exemptions under Section 54 (property reinvestment) have been capped.

🔹 6. Stock Market TDS & Reporting Norms

-

New TDS rates apply to high-frequency traders and HNIs.

-

More detailed PAN-Aadhaar linking requirements for investor accounts.

-

Taxation on dividends and stock buybacks has also been revised.

🔹 7. Digital Lending & Fintech Regulations

-

RBI has tightened the digital lending norms to curb predatory practices.

-

NBFCs and fintech platforms must disclose all fees upfront and ensure better grievance redressal mechanisms.

💡 What This Means for You

-

Taxpayers need to reassess their investment and saving strategies under the updated tax regime.

-

UPI users should track high-value transactions to avoid surprise charges.

-

Credit card users should be vigilant of new disclosures and billing cycle changes.

-

Investors must review mutual fund portfolios to ensure compliance and optimize post-tax returns.

These changes aim to increase transparency, improve compliance, and streamline financial governance in a rapidly digitizing economy.