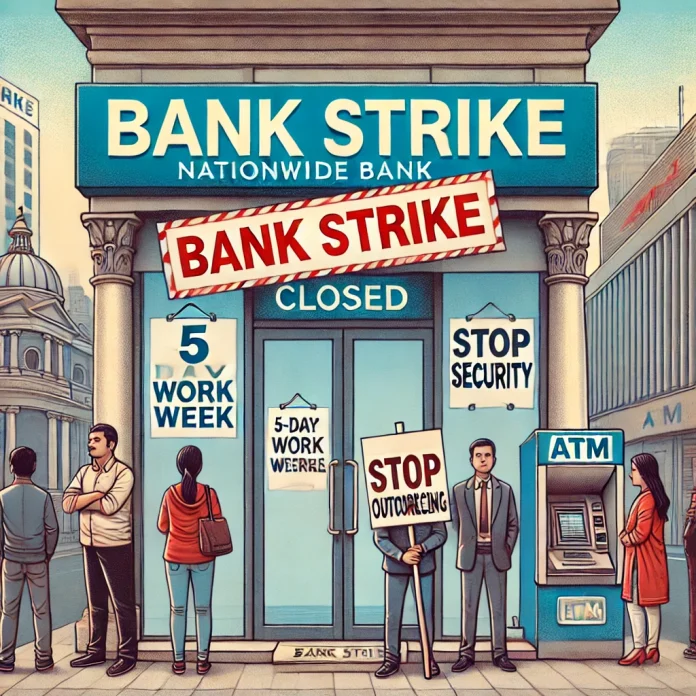

The United Forum of Bank Unions (UFBU), an umbrella organization comprising nine bank unions representing over eight lakh employees and officers from public sector banks, private sector banks, foreign banks, cooperative banks, and regional rural banks, has announced a two-day nationwide strike on March 24 and 25.

Will Banking Services Be Disrupted?

Although major banks such as the State Bank of India (SBI) and Punjab National Bank (PNB) have not released official statements regarding the strike, news agency ANI has reported that the strike will significantly impact banking services across public sector, private sector, and regional rural banks.

According to Pankaj Kapoor, Vice President of the All India Bank Officers Confederation (AIBOC), banking operations will be disrupted for four consecutive days. This is due to the strike coinciding with a weekend:

- March 22 (Saturday) – Working day

- March 23 (Sunday) – Bank holiday

- March 24-25 (Monday & Tuesday) – Strike by bank unions

As a result, key banking services such as cash transactions, clearing house operations, remittances, and loan processing may be severely affected.

Why Are Bank Unions Striking?

The UFBU has put forth several demands, urging the government and the Indian Banks’ Association (IBA) to address various issues concerning employees and officers. The key demands include:

- Adequate recruitment in all cadres to address workforce shortages.

- Regularization of all temporary employees in the banking sector.

- Implementation of a five-day work week across all banks.

- Immediate rollback of recent government and Department of Financial Services (DFS) directives on performance review and the Performance Linked Incentive (PLI) scheme.

- Strengthening security measures to ensure the safety of bank officers and staff from assaults or abuse by unruly customers.

- Filling up of vacant positions of workmen and officer directors in public sector banks.

- Resolution of pending issues with the Indian Banks’ Association (IBA).

- Amendments to the Gratuity Act, raising the ceiling to ₹25 lakh in line with government employees, along with income tax exemptions.

- Retaining a minimum of 51% government stake in IDBI Bank to maintain its public sector status.

- Stopping micromanagement of public sector banks (PSBs) by the DFS in matters affecting employee service conditions.

- Putting an end to outsourcing of permanent jobs in banks and eliminating unfair labor practices.

The banking strike is expected to cause significant inconvenience to customers, and those planning financial transactions during this period are advised to make necessary arrangements in advance.